As digital lending platforms grow in demand, local banks and private lenders are struggling to make the change to online user interfaces. In response to this challenge, Luna Connect has officially released The Luna Connect Digital Transformation Playbook, From Traditional Local Bank to Digital Lender: How to Make the Transformation in Weeks,

Why local lenders need this playbook

According to a recent report, online banking use has risen by 23%, and mobile banking use has increased by 30%. With the ongoing threat of the Covid-19 pandemic, businesses have awakened to new ways of functioning, and these numbers are likely to increase even further in years to come. Local banks built on traditional models have to step up to the changes we’re seeing, or they will lose customers - it’s that simple. While in the past, digital transformation was more of a luxury, and companies could choose if they would follow this trend at all and if it would suit them, it is now a matter of urgency. Customers are demanding a seamless digital experience from banking services, and lenders must meet this need or be left behind.

Benefits of the 5-step framework

At first glance, digital transformation can look very intimidating, and it’s understandable that traditional banks would shy away from this. But with the right guidance and simplified lending solutions, it’s possible to make this shift effortlessly. The Luna Connect Digital Transformation Playbook offers a 5-step framework that helps local banks transform into digital lenders in weeks.

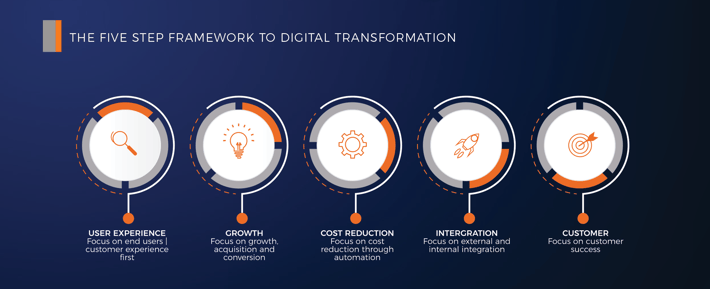

This practical framework involves the following aspects that help you execute and implement online lending solutions:

- User experience - Focus on end-user experience. Luna re-constructs the customer journey digitally, eliminating branch visits for loan applications.

- Growth - Focus on growth, acquisition and conversion through a combination of marketing, managing and reporting.

- Cost reduction - Reduce costs through automation and flexibility through technology.

- Integration - Focus on external and internal integration for more efficient operations.

- Customer - Prioritise customer success for business success using online tools for customer engagement, payment, compliance and support.

Luna Connect is a fintech firm that facilitates and accelerates digital transformation in small to medium-sized financial institutions, offering specialist lending solutions. Our digital lending platform allows local lending institutions to integrate existing customer relationships with personalised online experiences. With no capital investment required, local lenders can use the Luna Connect Digital Transformation Playbook to easily deliver digital lending experiences in just weeks. To find out more, visit our site or email hello@lunaconnect.io.