Engaging in digital transformation can prove challenging but intentional disruption of your own products and services can become a winning approach to successful change if businesses determine a suitable strategy. Self-disruption occurs when a business proactively replaces one product or process with another. Forward-thinking incumbents recognise the need to self-disrupt rather than leave this move to competitors, such as Microsoft disrupting their own enterprise software products with Azure Cloud.

How Local Financial Institutions Should Self-Disrupt During Digital Transformation

Feb 15, 2022 11:00:00 AM / by Brian D'Arcy

5 Top Benefits of Digital Transformation For Local Banks

Feb 1, 2022 10:00:00 AM / by Brian D'Arcy

Has your company undergone a digital transformation?

Especially in the financial sector, digital transformation is crucial to the survival of businesses. In a nutshell, it is the up-gradation of existing processes or introduction of new ways of carrying out business activities using digital technologies that enhance a customer’s experience, leading to higher conversion rates for the company.In banking, this integration of digitisation leads to fundamental changes in how financial institutes operate and deliver value to their customers.

Moreover, it refers to the process of transforming an organisation into a digital business. It is not just about digitising the existing processes. It is also about the integration of new technologies and a new way of thinking that will help financial institutions to more effectively serve their customers, generate new opportunities for innovation, and stay ahead of the competition.

The main goal of digital transformation is to stay relevant and competitive in a world that has become predominantly digitised and where anything and everything can be done online.

So, what exactly are the benefits that digital transformation can offer those in the local banking and lending sector? We uncover five of these benefits below,

- Customer Experience

- Online Trust

- Efficient Customer Acquisition

- Personalisation

- Innovation & Agility

Top 5 Industry Trends That Will Shape 2022 For Digital Banking

Jan 25, 2022 12:00:00 PM / by Brian D'Arcy

Increasing capital and improving the customer experience have been the focus of banks and credit unions' efforts to catch up with their competitors. Advanced analytics, innovation and modern technology, as well as a new approach to the workforce, have been the focus points.

Due to the rapid development of technology, the competitive landscape continues to expand, offering simple engagements and seamless experiences, causing existing relationships with banks and credit unions to crumble. For any organisation, there are a variety of options available for partnering with third-party providers to quickly deploy solutions to meet customer demand instead of developing them internally. Institutions can proactively modernise their existing systems and processes alongside partnering with fintech and big tech competitors.

Why API Integration Is Important In Digital Transformation

Jan 21, 2022 12:00:00 PM / by Claire Gibbons

It can be difficult for local financial institutions to keep up with the latest must-have features when digital technology is always evolving. This is where APIs can help position a lender quickly respond to the needs of the digital borrower.

Increasingly, banks and lending institutions are using APIs to adapt to the evolving needs of their consumers and become more innovative in their digital banking efforts. In fact, banking and lending institutions use APIs every day. With API functionality, digital banking features like income deposits, bill pay and money transfers between accounts are possible.

5 Things Local Financial Institutions Can Do To Acquire New Customers In 2022

Jan 19, 2022 12:00:00 PM / by Brian D'Arcy

There are numerous ways for a financial institution can find and welcome new customers this coming year that take the very best of the finance customer relationship and breathe new life into touchpoints and interaction. By making your financial institution customer and service centric, you can reach more clients, leverage the right tools, and gain more customers in the coming year. Here are our recommendations for your financial institution in 2022.

Take The Leap Towards Transforming Into a Digital Lender

Dec 16, 2021 10:30:00 AM / by Brian D'Arcy

Digital lending is by no means a new concept. With the nature of today’s consumer in a fast-paced world where everything is available via the internet, from ordering a pizza to the latest research on quantum mechanics, people have grown accustomed to anything they desire being fast, convenient, and accessible via a computer or mobile device. To meet this demand, many institutions have leaned into digital transformation and become digital lenders.

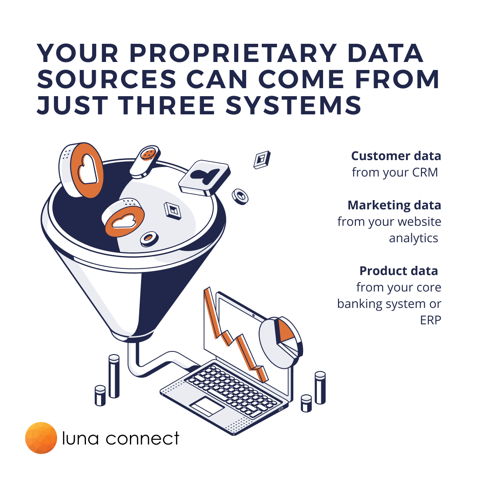

Data Driven Marketing for Local Financial Institutions

Dec 13, 2021 10:03:00 AM / by Greg Serandos

Data Driven Marketing for Local Financial Institutions

We are excited to kick off a series of monthly guest posts by friends of Luna Connect. Greg Serandos is a digital marketing strategist from the US and is passionate about helping local businesses compete against large financial institutions. One of those ways is to more effectively use customer data, then launching smarter campaigns to gain competitive advantage.

Explainable AI: Building Trust In AI For Digital Lending

Dec 9, 2021 10:15:00 AM / by Claire Gibbons

Artificial Intelligence and Machine Learning are certainly hot topics on everyone’s lips lately. With AI seemingly present in every facet of modern life, from checking in with Siri or Alexa about tomorrow’s weather to the chatbot on any given website, the possibilities are seemingly endless. Many people know the surface-level basics of what AI is and can do, but may not know just how much AI affects the financial sector. A lack of understanding often leads to mistrust of the technology, especially when money is involved. Understanding Explainable AI and what it could mean for you will open your eyes to a whole new world of possibilities with Luna Connect.

Transform to a Digital Lender in Weeks With Our Digital Lending Platform

Nov 22, 2021 10:00:00 AM / by Brian D'Arcy

If you’re a financial service and credit provider, you’re likely to be one of many that are stuck in mid-transformation, struggling to successfully transition from a traditional lender to one that offers digital experiences to an ever-changing online market. Luna Connect provides digital lending software to help loan providers with this move. However, we’ve noticed that moving online can also be an obstacle to traditionally designed business models. To that end, we’ve released The Luna Connect Digital Transformation Playbook to guide you in this process.

How Luna Connect’s Digital Lending Platform Transforms Local Lenders

Nov 17, 2021 11:00:00 AM / by Brian D'Arcy

Personalisation, speed, and cost-effectiveness. These are all things that local lending institutions are in dire need of and the only way through the tunnel is to seamlessly digitise in order to see the light at the other end. Luna Connect, a disruptive fintech company, is breaking down barriers to digital transformation by enabling traditional banks and local lenders to provide a more personalised customer experience through digital integration and automation. We take a look at how they are fast becoming the best lending software around.