Automate Credit Decisions with Digital Lending and Open Banking

Apr 13, 2021 9:53:05 PM / by Brian D'Arcy posted in Digital Lending, open banking, psd2, fintech

Practical Guide to Open Banking and PSD2 Part III

Jun 20, 2020 8:05:40 PM / by Brian D'Arcy posted in Luna Connect, AI, Digital Lending, open banking, psd2

When talking to customers about Open Banking the two questions we get asked most frequently are 1) can I see it in action (does it really exist) 2) do I need to be a registered AISP. I'll be going through both of these in this post. If you haven't already read the other two posts in this series check them out here Practical Guide to Open Banking and PSD2 Part I: Lending, and here Practical Guide to Open Banking and PSD2 Part II: Are you ready?

Practical Guide to Open Banking and PSD2 Part II: Are you ready?

May 23, 2020 3:05:20 PM / by Brian D'Arcy posted in Luna Connect, AI, Digital Lending, SME Lending, open banking, psd2

In this post I'll outline how to plan your Open Banking project, and ask is Open Banking ready, is your business ready, and most importantly are your customers ready. If you haven't read Part I of this series you can read it here Practical Guide to Open Banking and PSD2 Part I: Lending.

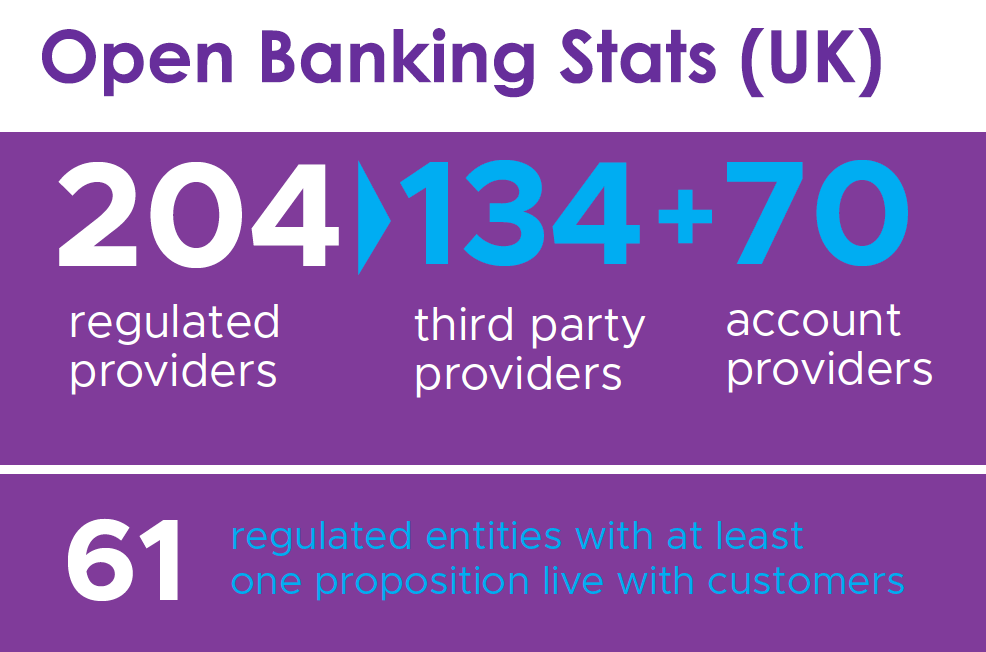

The OBIE in the UK publishes a monthly report on the Open Banking ecosystem, regulated entities and providers. This is a great source of information on adoption, and the Open Banking February Highlights provides stats on the number of successful API calls having risen from 280.5 million to 321.3 million (December 2019 to January 2020).

Practical Guide to Open Banking and PSD2 Part I: Lending

May 16, 2020 3:28:59 PM / by Brian D'Arcy posted in Luna Connect, Digital Lending, SME Lending, open banking, psd2

In this post, and the next 2 blog posts, I'll cover how Open Banking and PSD2 can be used practically, today. Lending is changing from face to face and phone interactions to self-service online digital experiences, and this is being accelerated globally to protect staff and customers from the spread of COVID-19 (Coronavirus). Data and APIs are the key ingredients in driving down costs and risk, increasing automation, and delighting borrowers with amazing customer experiences.