Learn how SME Finance and Leasing Solutions are transforming lending

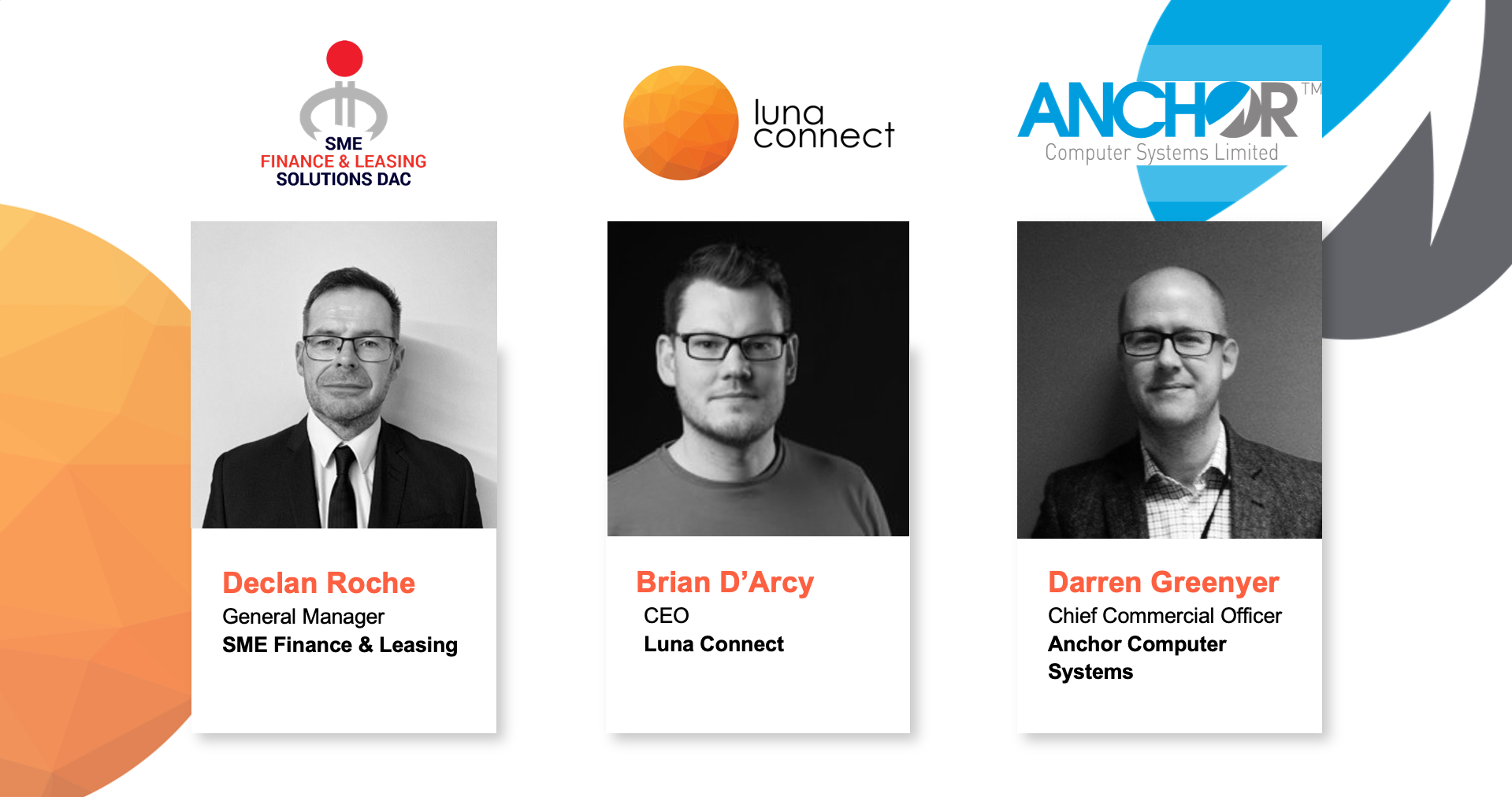

Access our On-Demand Webinar and learn how SME Finance and Leasing Solutions DAC are transforming lending for SME's, including a very insightful Q&A with Declan, Darren and Brian covering customer service, digital transformation, Covid-19 and Open Banking.

- Declan Roche SME Finance & Leasing

- Darren Greenyer Anchor Computer Systems

- Brian D'Arcy Luna Connect

Learn about

- Growing a diversified loan book online

- Delivering high levels of customer service through digital channels

- Transforming operations with real-time reporting and analytics

- Reducing costs with automation and end-to-end integration

Webinar Transcript

Introductions

Fergal Geraghty: Good morning, everybody. Welcome to this morning's webinar with luna connect and Anchor Computer Systems. My name is Fergal Geraghty, and I'm commercial director with luna connect. On this morning's webinar is on how SME Finance and Leasing Solutions are enabling SMEs access finance quicker with an automated loan-origination process.

Just introducing the speakers this morning, we have Declan Roche, who's general manager of SME Finance and Leasing Solutions, Brian D'Arcy, CEO of luna connect, and Darren Greenyer, who's chief commercial officer of Anchor Computer Systems. Now, I'll hand over to Brian and Darren to give a brief introduction to learning Anchor on our platform.

Brian D'Arcy: Thanks, Fergal. I'll just give a quick intro into luna connect. We're a fintech platform, a cloud-native, digital lending platform that helps lenders get online quickly and automate a lot of the back-end processes that are associated with underwriting the loan.

Our platform is very open, where you can easily connect in your order systems via APIs. We've got thousands of users who are actively using the platform, and we work with both regulators and non-regulators lending organizations.

Darren Greenyer: Thanks, Brian. My name is Darren Greenyer. I am the chief commercial officer at Anchor Computer Systems, been with the business just over two years. Prior to that, I worked as the head of commercial at Raphaels Bank, running a medium-sized motor finance books, so I'm very familiar with lending money and the trials and tribulations of attempting to collect it.

For those of you who are not familiar, Anchor Computer Systems offers a full end-to-end enterprise loan management system, covering the three key areas of loan origination, loan servicing, and -- as I alluded to there, arguably most importantly -- loan collection. Technology is cloud-based, offered as Software as a Service hosted across two-tier, three data centers in London.

Business was formed in 1981. We've now got 60 employees spread over our development, implementation, and support functions. All of whom are based in-house across our two offices in Bangor, North Wales and Birmingham, although more recently, based truly in-house due to the COVID challenges.

The system itself is used by over 200 customers, including 12 over in Ireland, across a variety of markets from small personal loans to multi-currency mortgages and everything in-between. In terms of the collective loans transacted and managed on the system, there are over six billion pounds worth of loans, over a million agreements.

Application volumes, certainly pre-COVID, we're in the region of 100,000 a day. We were delighted to partner with luna and SME on this project. I'll hand you over to Declan from SME who will talk through their requirements and experience.

SME Finance & Leasing Digital Transformation

Declan Roche: Thanks very much, Darren. Again, just a quick intro, Declan Roche here, the general manager with SME Finance & Leasing Solutions DAC. We're a direct lender into the Irish market that commenced trading in 2014. We're led by the CEO which is Eugene O'Donovan and experienced management team where our office's based here in Callan County, Kilkenny, Ireland.

We're primarily business-focused finance solutions to a wide variety of customers across the Republic of Ireland. From, I suppose, 2014, when we started, we have sourced funding from several parties including shareholders, Beach Point Capital, and most recently, Strategic Banking Corporation of Ireland.

What is our market? Our market size ranged from 1,000 to 70,000-plus VAT on asset finance. Our average amount of finance advance last year, 2019, was 8, 000. We provide a various types of business finance to protect valuable working capital for the Irish SMEs, which include business lease agreements, high-purchase agreements, sale and leaseback, and most recently, professionally finance product.

Obviously, since we've started trading in 2014, the business has seen numerous challenges, which we've tackled head on. As we evolve and as we grow, these challenges continue to come in front of us.

When we reviewed 2019, and we set out for 2020, I saw what we listed out was a couple of key changes that we want to take on. These included real requirement for data and near real-time reporting on all aspects of the business.

We want to real hands-on in all the various departments within the actual SME finance business model. We wanted to utilize data to set KPIs to manage and grow the loan book. Again, that was an ability to merge data, sync it with KPIs in all the various departments, to allow us to grow this loan book.

Obviously, the competitive marketplace in Ireland sees the need for a management requesting constant updates because we have to be able to move and adapt to challenges as they come and create an automated finance model that uses a trusted set of accurate financial data.

Our digital requirements. We wanted a hybrid delivery, an ability to leverage against the consistent infrastructure across our organization. Simplicity and scale, to be able to respond to the needs of the business quickly and efficiently. End-to-end service, deliver service not just to the vendor but also to the end user, which is very important to us in terms of our key service deliveries.

Process efficiency, employees access application/services quickly and efficiently. Our reporting hub, we wanted to create a platform where we could bring the cradle to the grave integration of all of the proposal life cycle. Customer experience, improving customer experience through trusted data, APIs and AI.

What was our solution? Luna Connect and Brian D’Arcy and Co., we thought this was our solution and has proven to be our solution.

Luna Connect for the direct borrower loan applications and open banking for all loan applications. Leverage existing Anchor Sentinel capabilities and integrations. Anchor Sentinel for underwriting, payouts, and credit control. The integration of our IT systems, Mindaclient which is used for our CRM, Sage for accounting/financial, and VoiceGrid which is used for our communications.

Our reporting hub. This hub was created by luna, which enabled us to analyze the platform, integrates data from multiple systems providing single source of truth, data from our Anchor Sentinel integrated via scheduled backup, data from luna connect and Mindaclient via APIs, and data store and a BI tool creates reports and dashboards.

When we put all this together and we integrated all our stakeholders, what were the results? We had a fully integrated and managed infrastructure solution. This enhances the digitalization and automation of the asset finance solution for the vendor and the end user/SME.

Risk management, it assists with the diversity of the loan book. Sales focus, it integrates the activities of our CRM system into the reporting platform, again, which is hugely important in terms of driving the long book.

If will behind all this integration, all the solutions, and all the results, what were our key business benefits? 2020, as seen, our loan book grow by 33 percent. Our average amount financed is up by 29 percent. Our approved vendor's dealers referring business continually is up by 25 percent. Our conversion rate on our proposal presented has grown by 27 percent.

That outlines the journey that we've had with luna, with Anchor, and all our other various stakeholders within our organization. I hand back over now to Brian for his end of things.

Brian: Thanks, Declan. First, we're going to go into what that overall platform looks like that was put in place to support all the challenges and business process that Declan just described. Darren, do you want to take us through what that platform looks like?

Anchor Computer Systems

Darren: Thanks, Brian. I think it was clear from pretty much day one when we met with Declan and Eugene that from the project outset, they really wanted to digitalize their business, to drive process improvement, reporting improvements, and general operational efficiencies throughout their business to support their growth ambitions.

What you can see on screen here is a representation of the SME opted for solution and the key modules taken. It begins with the luna connect interface, which Brian will talk about a little bit more detail after me. From my perspective, the important call-out regarding luna connect is the fact that the full integration into the Anchor Sentinel platform is already in place and is available to be used by other businesses.

It's worth also probably noting that the Anchor Solution being modular in nature can be deployed in different ways depending on a business's requirements. For SME, we looked at a full end-to-end solution, but we have a mixture of use cases where some customers will, for instance, just use it as a back-end servicing solution.

I'll talk about the key areas for SME in a little more detail as we move through. Looking at this diagram and looking at the core modules across the middle, we have our Sentinel proposal module for originations, and that has the ability to use our decision engine, drive automated response and decisions where appropriate.

The administration module sat next to it, which is for loan servicing, and it's really the core of the solution. Then we have collections for ensuring the management and collection of loans in arrears.

There are also a number of sub-modules that you can see here that complement the system and assist in efficient management such as our document management system. That essentially ensures all documentation is appended to the customer and agreement record for ease of retrieval, particularly relevant in the world of GDPR.

You can effectively pull all of your customer information into one place in a PDF at the click of a button. We have the ability, below administration, to automate account reconciliation into your chosen accounts package and also collections via direct debit payment, cards, etc.

Just having a look at some of the products supported, a real variety. As I said in the introduction, we essentially support anything from a small personal loan to a multicurrency mortgage and everything in between. The platform also has the ability to run multiple products. You can have different products within the same instance of the solution.

If we get into a little bit more detail around starting with the proposal module, the proposal module essentially handles an agreement from inquiry to payout. The brief from SME was very much to systemize existing paper processes, including the creation of documentation, creating those documents for eSign where appropriate, and then workflow management.

The Sentinel proposal module through its workflow management has the ability to automate communication, both internally and externally as the finance proposal progresses.

For example, if you send a document for signature and have not received it back, the system can invoke a workflow movement, which will trigger reminder to the customer that the document requires signing. This could be an email or an SMS. The proposal module link also has links to various third parties that can assist in decisioning, such as CCR, open banking experience, etc.

We just have a look at the proposal decision engine. Essentially, these third-party data elements can be utilized within the decision engine. A creation of bespoke credit and business rules can then flow the proposals accordingly.

For instance, you can build in knockout rules around min and max values of loans, min and max values around the customer, particular asset types that you're particularly looking to write.

Essentially, depending on the product, the process, your internal credit risk policies, you can use the decision engine in tandem with a proposal workflow to generate full end-to-end automated decision in. Once that's done, then it passes into the eSign portal. The next slide.

Thanks. Once the decision is made, documents can either be produced for wetness signature or for eSign, or is in the case of SME, a mixture of both depending on the business process or any funding covenants. Once the deal is then signed and sent back, it can be paid out. Then it moves and leaves in the administration module.

Now, administration is really the core of the solution and drives all of the back office functionality. From an SME perspective, all the core data is held in the administration module. It's then taken into the luna reporting suites for Brian and the team to work their magic. Brian will share some of that magic with us shortly.

It also drives the accounting and direct debit information into the sub-modules. One of the key elements with all the available modules is that the solution that Anchor provide is primarily off the shelf. As such, the focus has always been on ensuring the system is highly configurable to meet user's requirements.

Having previously worked for a bank and been heavily involved in the procurement of a loan management system, anytime you can choose configuration over coding will dramatically reduce the project costs. I certainly know that was something that resonated with the team in SME.

Now, having a look at the collections module -- a bit like children -- whilst we should not have favorites, I think the collections module is probably mine. One-off, I guess, if not the hardest thing in lending, money is actually getting it back in. The collections module allows for a fully automated solution, though the pragmatic approach taken by SME is to use it to complement their collections team.

Again, it's the set of workflows that are constructed and picked up agreements as soon as they hit arrears. The system can then drive automated activities such as sending emails and SMS, advising the customer that they've missed a payment.

Once the SME collections team are then at their desks in the morning, that day, Mr. Payment customers will have already been notified and will be expecting a call from the team to have a conversation about how they can address their arrears. Extending their potential for automation, we also have our self-service customer portal which is the next slide.

Essentially, when a customer misses a payment and they're sent a message, either via email or SMS, it can have a link embedded into it. Within that link, it will take the customer to the self-service portal. This then gives SMEs customers an area where they can make a payment, they can view any documentation, that's how they can see payment profiles.

There's a number of key activities that the customer can do within their own my account portal, which then reduces the need for them to pick up the phone, and ring SME and add to operational expense for the guys to service. They can essentially service themselves.

It also gives the opportunity for customer to self-cure missed payments before anyone from SME even needs to chase it, again in driving that operational efficiency. That takes us to the end of the core SME solution. If I hand back to Brian, we'll go back to the start. He can take you through the luna front end.

Luna Connect

Brian: Yes, thanks, Darren. Thanks, Declan as well for setting the scene earlier for us. As Darren said, we're taking a step back to the start now and really looking at what does this look like from the borrower's point of view and what they see as they're going through this journey. The first thing we're going to show you is the borrower's view of the journey.

This is where both your new or your existing customers come to complete their loan applications online. The first piece area we're looking at is for an asset finance use case. Here, straight away, we're going to ask the borrower about the assets, how much is the cost, and is there any package change or anything like that? As part of that process, then we're automatically calculating.

The loan and the repayments are in the background for the borrower. They just give us the information and we make it as simple as possible for them. As we move here to the middle screen, and this use case was for a limited company.

By the borrower just typing in some other information, we're automatically in the background, pulling the data from the CRO or company's house, and pull in as much of that information as possible without the borrower having to do a whole lot of work. This makes the process for the borrower a lot slicker, and for the lending business, and for SME, finance and leasing.

What this means is they get better data. You're ensuring that you're getting really high quality data as part of that loan application process and you're reducing the amount of time that your lending team have to spend following up with people and looking for more information or going to other systems trying to validate data.

This can be done for all different types of data points, one example is addresses. By people typing part of address, we'll actually validate that and pull in all the information into the platform.

The last piece here we just showed is like an online calculator. Once you have all the information gathered, and you know the amounts, then we recommend the products and let the borrower try out the different options that they have to repay it and how that's going to work.

The next step we're going to take a look at is, once the borrower has input all the loan application details, and have completed that, we generate a task list for the borrower. This task list is based on a product they have selected, how much they've entered, and what your own credit policy is.

Based on this, we will give them the set of tasks that they need to complete. For example, might be that they're a new customer that needs to do their onboarding. It could be their photo ID, their proof of address, they can offer bank statements, and all those types of things.

We generate that task list and we assign a status to it. What luna connect does in the background is, it monitors the task list and it'll notify the borrower when tasks have not been completed. They'll get reminder emails and when they've completed a task will automatically check it off the list here so they can see that they're done with that part of the process.

What we're doing here is, you make it really easy for the borrower, so they can go in and do all this themselves and then all the full visibility into where they are in the process.

It also reduces the amount of time that your lending team is going to spend picking up the phone ringing people, chasing people for documents, trying to validate things, and if documents are right because in the background, we're automatically sending those email reminders automatically sending the follow ups. When somebody uploads a document, we're validating them in real time in the background.

The real benefit here is that you're taking all that work away from the lending team. In the middle piece here, then we're just showing [inaudible 23:30] document upload piece looks like for the borrower. They can do this on any device. If they're on a laptop, they can upload a doc. If they're on their phone, they can just take a picture.

This is this isn't just letting them upload the document, we're validating it in the background before it gets shared with the lending team. The last piece here is showing that when we ask them for bank statements, it gives them the option of uploading the document, but also giving them the ability to use open banking to go on connect directly into their bank account and pull that data.

We're going to switch over to what does the back end piece look like. As the borrower has gone through the process of filling out the loan application and uploading their documents, how does the lending team actually see that, or how does that come to the lending team? That's what this view here has shown.

This is the task board, which shows each loan application and what stage is in that loan origination process. You can see everything from someone who has started the loan application, but they haven't finished it, the finished loan application but they have not finished all their tasks and they finished their tasks and now it's in progress, it's being reviewed.

All this can be monitored by the team to see exactly where things are in the process. If they want to step in, they can but it'll automatically move through these stages as the borrower is completing different tasks that we've assigned to them. Each of the boxes that were on the previous screen represents a loan application.

Once you drill down into that, what you can then see is all the data that's been submitted as part of that loan application. Everything from the loan details, the details that the person has put in, the business details, and even down to what tasks were assigned and which of them have been completed or not, what documents have been uploaded, and are they valid or not.

Then, suppose as well as that, and the output from any algorithms that were running on the data as is being processed. If someone connects a bank account, we're able to run all the analysis on that to see if all the data is there and all the metrics match up for what their credit policy is.

There are also AI models in there where you can leverage your existing data to train our models that can then help making those decisions. These are all key processes that can be done to automate that charity slip. By the time it hits your loan management system, or by the time a bank hits anchor, you know that you have all the data, you need to underwrite that loan.

I suppose another important part of this, and Declan talked a lot about this, was the reporting or the ability to produce the reports on top of the data. Here, what we're showing is all of the management dashboards that are available on the platform.

Here you can monitor the performance of the business in real-time, know how things are trending month over month, how products are performing well. It's fully integrated so pulling in the data from all your other systems, got all the anchor data sitting alongside the luna connect data, and also bringing in your CRM data.

That means you have that fully rounded view of the business. You're able to just see everything from when someone hits the front end to submit a loan application true to the collections and the CRM and everything else in the process. That brings us through all the different components of the platform. I'll hand it back to Fergal so you can start [inaudible 27:17] if there's any questions that need to turn on to.

Q&A

Fergal: Thank you, Brian. Thank you for that presentation. Thanks to Declan and Darren for those excellent presentations. This is the Q&A section. Thank you all. Just looking at the Q&A box. Thank you all for submitting questions.

I'm just going to pull some of them out with the time you have left. Declan, I think this is probably for you. There's a question here on service level efficiencies in SME finance and leasing. Did you see increasing efficiency?

Declan: The simple answer in that probably is yes. Brian has probably highlighted, in the most recent slides that we looked at, there are a couple of key things that the borrower was getting a sleeker service. By that online application, and the ability to control the loan application through the system, they dictated how slicker it was.

The other side of that further was our underwriters are getting really high-quality data. They weren't losing time in terms of information that might be outstanding. Even if the information was outstanding, you could see there where Brian highlighted, the relevant flow and dashboard where stuff was outstanding. You could reach back out to the borrower, and pull in the relevant information.

As a result of that, efficiency in terms of the application and the information getting to our underwriters and the quality of that data. The bottom line was, there was a decision made fairly promptly.

One standard decision, once you have a customer and SME, getting a positive decision in terms of funding requirement, that whole cycle then starts moving quickly. We then reach out to dealer, who is one of our key introducers of business and we start requesting in the information, now EDI invoice, to prompt the legal docs to start moving.

If you think about anchor in terms of where they fit into our business model one, key components here was the ability as well for real-time reporting, and a live dashboard. As Darren outlined in his slides, the whole dashboard scenario that we have internally here now is when we request that invoice from the dealer, and it comes in, it's put into the system and anchor.

Now we can see, there's 25 invoices, there's 26, there's 27 and on the back end, then our legal docs start pulling out. The whole integration of the various stakeholders has hugely increased our service levels.

In a competitive marketplace services is everything and we pride ourselves on a very, very high service out.

Fergal: OK, thank you. Just looking at another question. It's probably a hot topic at the moment on open banking. The question is on a little bit of open banking challenges and implementation and how is it received by users? Brian or Darren?

Brian: I suppose I can just take it initially, specifically on the SME Finance use case. Open banking, like you said, is a hot topic. There's huge, huge potential there for a techno really changed the whole lending landscape and how people share their data.

Moving from having to scan in documents or PDFs and send them in to people where you have to go through them with a highlighter or some other way that you're monitoring the data, to actually being able to connect directly to the source and pull that data, and it automatically run algorithms across it.

When we pull in that data we're able to run over 20 different algorithms across it, knocking out everything from balances to data that's going in and out of the account, then also been able to feed that into some of the other algorithms that we use as part of the process.

To get to the point where we are now has been a really, really long journey. It's taken years. The whole open banking thing has been going on for a long time. The APIs have been actively available now for over a year, but it took a good six months for them to bear down and to get the data.

The biggest challenge with it is the consistency of the data coming back from all the different banks. Each bank will send something slightly different, so you have to tweak things a bit for them. They were the challenges in the early days.

The challenge now is adoption, getting people to trust it and to click the connect button, versus click the upload PDF button. We've got people doing both in the platform. We've got some people who are quite happy to connect their bank account and share their data that way, but we've got people who still want to upload documents.

For us, the platform can handle both. For Declan, for his team, they'd like to see more people connect and using open banking because they get much better data and a richer way they can analyze it. That's going to take another while. I think the adoption is the key thing now.

Darren: Brian's absolutely right. Adoption is the key with open banking. Interestingly, with the advent of COVID-19 and the effect it's had on personal income, business income, that isn't necessarily being reflected quite as quickly in traditional credit reference agency reports.

The relevance of open banking is probably greater now than it's ever been. The more banking and lending organizations that start to adopt open banking, will start to drive the consumer/business adoption rates. Hopefully, we'll see that increase.

Fergal: Declan, this is probably back to you. As this was a big step change, big project for your business, could you talk a bit more about some of the challenges on the implementation, like some of the culture challenges?

Declan: Yeah, absolutely, Fergal. As you have quite rightly said there, it was a culture change, as well as internally, first of all, in terms of the staff and how we done things historically, and where we needed to move to.

It's interesting to hear Brian and Darren talk about the adaptation, now, of the PSD2. It's a huge learning curve for the SMEs out there, as well as all our potential customers.

Primarily, it was a big thing for our staff here. It was about sitting down with our staff and explaining to them where we wanted to bring the business over the next two, three, four years, and literally mapping that out on a platform for them, and showing all the efficiencies that could be brought with the integration of the stakeholders.

At the end of the day, it would make their life that small bit easier in terms of how they done their job day-to-day. Change was the biggest thing, absolutely. Implementing it, then, was about working very closely with Anchor and very closely with luna connect.

That literally involved weekly catch-ups, agreed agenda, a workload, and a week on week, how were we going and setting deadlines for the implementation of the whole process. If we didn't have those deadlines in place, the thing could go on and go on.

In fairness to both Brian and Darren, they were very professional in how they have delivered our finance solutions, and the whole integration for us. The biggest thing, first and foremost, was the staff and the buy-in there. Then, putting that roadmap, setting the timelines and striving to achieve those.

Fergal: Thanks Declan. I'm going to keep you on for the next question here. Just read it correctly. Your KPI targets are impressive. Can you talk a little bit more on these loans that increased, especially in these challenging times?

It's a great question. It is challenging times. Declan, a little bit...To get that question again, it's just talking about KPIs and how you're achieving them, especially the loans.

Declan: As the person that was asking that question there has highlighted, challenging times. Where we are with COVID, we launched the new SBCI loan scheme, and then COVID arrived. One of the key things for us, Fergal, in our loan book is our diversity within the actual loan book.

Within one of the slides, I mentioned that our small-sized deal is 1,000. Our largest, single deal we'll do is 7,000 plus cash. Our average-sized deal last year was 8,000. That's grown by 29 percent this year. It's the whole diversity of our loan book, allows us to thrive under business. That, on the back of then our alignment with SBCIE in the last 12 months, has allowed us access to funds.

We're highly competitive with anyone in the marketplace. That loan complication for the SME, that's open for two grand or three grand. We can now cater for the SME that's looking for a 60 grand borrow. We can be competitive in the marketplace.

Our whole integration in terms of our digital platform and our role in that, along with SBCIE funding, and along with the diversity of the loan book. I might add, I support a very, very strong sales team out there, who with the challenging times of COVID, didn't balk at that challenge. Saw it as an opportunity to talk to our dealers and deliver on what they're saying in terms of our service.

Again, our service and our turnaround to our dealers is very, very high. When we put that all together, we've seen great growth this year, bottom line.

Fergal: Thanks Declan. I'm getting lots of questions on the Luna Connect, Anchor partnership. I might sum them up in one. There's somebody asking about the integration between Luna Connect and Anchor more in depth.

Brian: I'll take the technical side of it. From a technical point of view, to work with the guys in Anchor was very straightforward for us. They had a platform there. As Darren said, they have a lot of things out of the box.

They had an API that we could use to be able to...Once the borrower had completed that loan application and we had got it to a stage where we knew that all the documents had been completed, everything had been uploaded. We were happy that everything was valid, and that it was a qualified deal that was ready to go.

For Declan and his team, they literally click a button and that button then will take all the data and all the documents, and everything that's needed for Anchor to do their thing. We'd package that up, and it's pushed over via an API into the platform.

The fact that as soon as we started working with them from day one, the API was there and we could just get going, was a huge advantage to us, I suppose because it meant it wasn't holding anything up. All the integration was there and ready to go on available.

On the back end of that around the reporting hub pace, it was pretty much the same. The guys already had a process in place where they could share the data from their system. They already had a process in place where they could drop the data on a schedule basis out, then we could integrate that in with all the other data sources and produce the reporting hub that Declan was talking about.

From a technical point of view, it was great for us because all those pieces were there, ready to be used. Technically for us it was just a matter of sitting down with the guys and working through it.

That process was great because from day one they were very open with us, and helped us through the process, and everything that I had hoped. From the technical side of things, Darren do you want to talk a little bit more about what that process is like and how you guys interact with people?

Darren: Thanks Brian. Each project for us is very different. That's because there's so many different variables in terms of solution selected, data migration, additional third parties. It was evident from the outset that SME were going to be a very good partner to work with in terms of their keenness to progress, providing things that we needed to help put the solution together.

Similarly, working with the guys at luna was very, very straightforward. We quickly jumped on a plane, came over. The three parties, we'd sit and do a initial project and scoping session. Then, we get into the nuts and bolts of actually what the integration's going to look like. How does the solution work?

We then bring in a very early stage dedicated project manager to work with stakeholders from the various parties, then we start to work through that implementation process. As I say, each project's different. With the SME and luna, we had an MVP, a minimum viable product, within 16 weeks.

Then, what we start to do is iteratively support and refine the processes. One of the things that we're very hot on doing with any new implementation is making sure that we go through a workshop environment with the key departments.

Having a look at origination, and having a look at collections. Looking at how that process currently exists within the business, how do we systemize it? Where can we bring in levels of automated functionality to drive Declan and Eugene's desired operational improvement?

Then, map that out in a plan, then start to build that. As Declan alluded to, weekly governance calls, make sure that the project's on time and delivered on budget and on time, both for our partner and for ourselves, as well.

Fergal: Thank you very much. Guys, I'm conscious that we're actually out of time. Thank you to everybody for logging in this morning and joining us on this webinar. Special thanks to Declan from SME Finance and Leasing for giving up his time to talk about their journey. Thanks to Darren from our partner at Anchor.

All our contact details are below. There is some questions still unanswered, I see in the window. We will follow up with those.