In this post I'll outline how to plan your Open Banking project, and ask is Open Banking ready, is your business ready, and most importantly are your customers ready. If you haven't read Part I of this series you can read it here Practical Guide to Open Banking and PSD2 Part I: Lending.

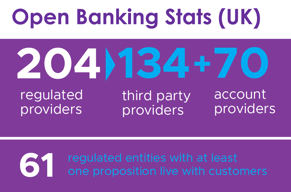

The OBIE in the UK publishes a monthly report on the Open Banking ecosystem, regulated entities and providers. This is a great source of information on adoption, and the Open Banking February Highlights provides stats on the number of successful API calls having risen from 280.5 million to 321.3 million (December 2019 to January 2020).

Banks made significant investments to implement APIs, and data aggregators are busy integrating with multiple banks to make it easier to consume data. While there are issues with data and customer experience as outlined in Part I of this Blog series A practical guide to Open Banking and PSD2 for Lending Part I, even with these shortcomings, it’s far better than todays outdated approach of relying on statement print outs and PDFs when analysing banking data.

Is your business ready?

First, do you require access to bank transaction history as part of your business processes, for example, if you are a lender do you require 3 or 6 months bank statements as part of your underwriting process. If you do, and you're not using Open Banking today, you need a plan. You need to map your customer journey, identify how you interact with your customers today and where Open Banking can make this journey better for customers and reduce overheads on backend processing. If you don't have a customer journey map already you should start working on it now.

Second, what regulatory compliance do you need to have in place. There are a number of options here, register as an AISP or partner with a provider. This really depends on your use case, you need to get the right advice on this early to make sure your implementation runs smoothly.

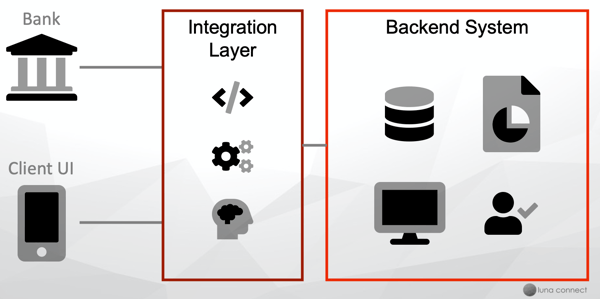

Lastly, do you have the systems in place to integrate with Open Banking APIs and process the data received. Does your existing technology support Open Banking and API integrations, how does your customer interact with Open Banking, where does it fit in the customer journey and does your backend have the analytics capabilities to analyse the data in real-time.

Are your Customers ready?

The short answer is "no". Adoption is not widespread with consumer and business customers. When you start using Open Banking you will need to guide users through the consent process. Their main concerns are security, and how it helps them (not you). For example, AIB and Ulster Bank customers do not need to perform any setup steps, if they are users of online banking they can start using Open Banking today, however, if you are a Bank of Ireland customer you need to install and configure a password generator app on your phone. You will need to provide this guidance to customers as it could be their first time using Open Banking.

When planning your Open Banking project put customers at the center of everything you do, and assume they have not used it before. Reassure them the process is secure and guide them through the bank's authorisation process (because the banks don't).

Where to start?

At Luna Connect we have been working with Open Banking since its introduction and have a tried and tested approach to transforming businesses from expensive, manual, paper based processes to data driven automation using Open Banking, APIs and Artificial Intelligence to deliver streamlined customer experiences and reduced costs for lenders. We use the Customer Journey Map as our core tool to drive this transformation.

If you want to find out more about Open Banking and Customer Journey Maps get in contact brian@lunaconnect.io, and subscribe to this blog and get notified when our next post is published.