Learn how Carlow Credit Union are transforming lending

Access our On-Demand Webinar recording and listen to Siobhan Gray, Head of Lending, on how Carlow Credit Union are transforming through digital lending.

Learn about:

- Increasing lending to Members and Non-Members

- Building a Member and Non-Member experience through Digital Lending

- Transformation in Lending and Underwriting Management

- Emerging digital trends in loan (lending) origination

- Seamless Identify (Know Your Customer) Management

Webinar Transcript

Introductions

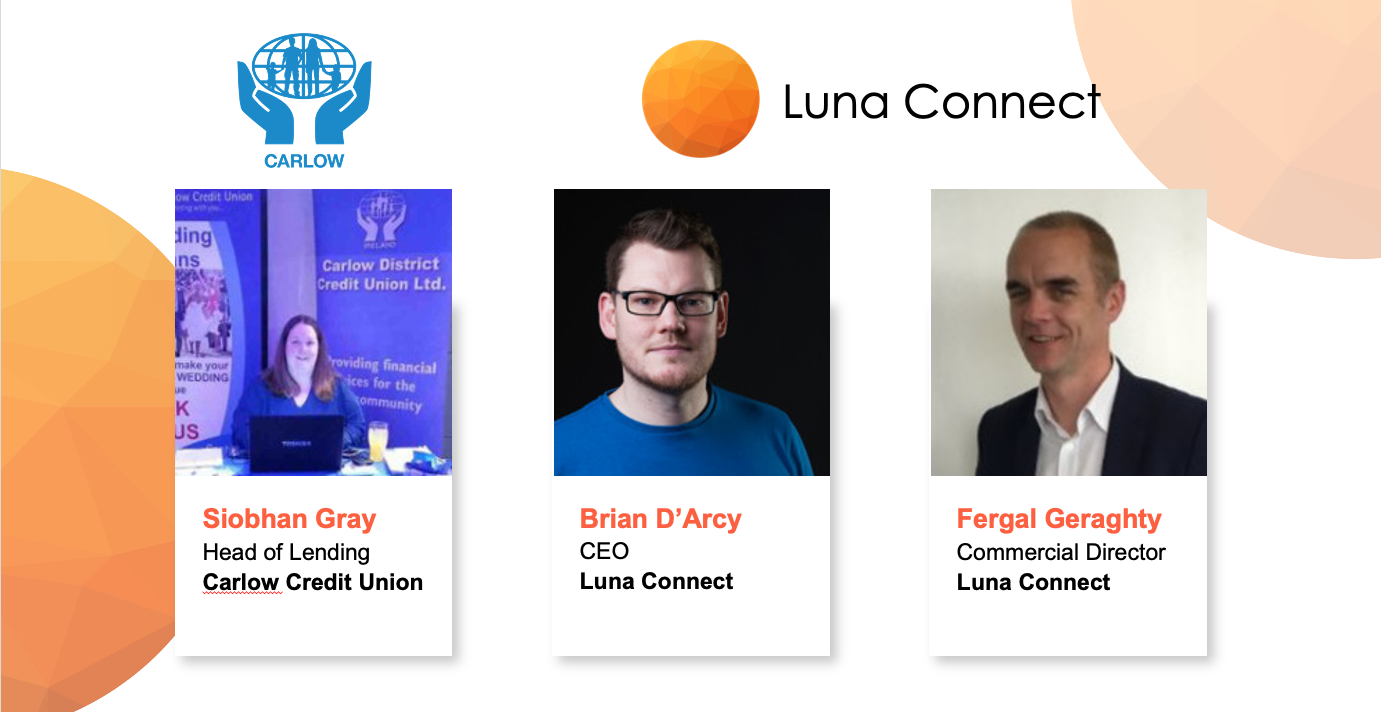

Fergal Geraghty: Good morning everybody. You're all very welcome to this morning's webinar with Luna Connect, Carlow Credit Union. Topic of this morning is how Carlow Credit Union are transforming lending through digital technologies. My name is Fergal Geraghty, and I'm commercial director with Luna Connect.

I'd like to welcome Siobhan Gray, who is head of lending with Carlow Credit Union. Siobhan may be known to some of you. I know she's very active in the credit union community. Siobhan will talk about the objectives and challenges Carlow Credit Union had and the outputs and results of working with Luna Connect.

Welcome Brian D'Arcy this morning. Brian's our CEO and founder. Brian will give a visual on the technologies that Siobhan and her team are using at Carlow Credit Union.

With those of you who are new to us, just a little bit about Luna Connect, we're a FinTech company based in Galway. We developed a platform that's focused on the lending, a loan origination journey, from the marketing department right through to loan processing.

Our clients are credit unions, asset finance, mortgage lending, SME lending and we're focused on bringing innovations and best practices to the journey.

Our mantra, as it says on the webinar, is make it easier, simpler, more efficient for stakeholders from the marketing departments, from members and non members applying for loans right through to underwriting lending teams and operators and management teams understanding their lending environment in real time.

Carlow Credit Unions Digital Transformation

Siobhan Gray: Thanks very much Fergal. Good morning everybody. I just want to start this morning with a brief introduction of Carlow Credit Union. We're over 130 million in assets with a member base of 33,000 active members with three offices in total.

Our main office is in Askea in Carlow, and two sub offices at Rathvilly and Mayo-Doonane. I suppose the main reasons we connected with Luna Connect was to help with our loan book challenges. Like a lot of the credit unions, our loan book challenges have been, to grow our loan book.

In Carlow, we lost a lot of manufacturing over the last number of years. We have now become a commuter town to a lot of people commuting to Dublin.

Our competition in Carlow was quite strong, like a lot of credit unions. The big major banks are here. We have other online and other money lenders in the town.

Also, we were approaching a global pandemic with COVID 19. Other challenges included attracting new members and targeting professions within our common bond. We wanted to target people that would look at the credit union as being the main lending provider.

The next part, then, we went on a journey to digitalization. This is how we came about why we had to do this. We do a good bit of affinity visits, banking at work. We went to a lot of industries, trades, and professions in our common bond.

We went down to look to see what they wanted from us as a credit union. At the top of it all they wanted was us to be more digital that they didn't have to come into the office.

We were very well respected. They liked our organization. They liked the core principles of credit unions, but the big challenge was that they didn't want additional opening hours. They wanted a digital option.

They want to be able to go online and put the ward working at the weekend and to be able to apply for loans online without having to come into the office. At the start of this journey, we didn't have the option for them.

Again, our competitors the big four banks, money lenders, new entrants, car financing/PCP could all be done online, where we couldn't.

Our goal was to rejuvenate Carlow Credit Union's model and to justify the loan book by having a digitalization option, by having our members be able to apply for a loan, become a member, and get the loan the whole way through it without having to come into the office.

After that, then we went for our tender process. The four big questions that we needed to ask when we were going out for tender was, we needed to be able to grow our loan book, to have a better member experience, reduce the processing cost, and reduce loan turnaround times as a result of introducing digitalization.

We went out, and we looked for the RFIs and the RFPs, the request for information, and request for pricing. We went to three providers, Luna Connect, another IT provider, and our current banking model provider. Luna and the others sent in their costings, their information, everything in relation to the digitalization option. We met all three.

A key we wanted was an end to end journey. We wanted a member to be able to log on, put in their information, and not have to leave that platform at all to get to the end. We wanted that it was smooth for them, that you could see where they were within the journey, that it was easy, and that it reflected what they would have to do if they were physically in the office, what they were used to doing.

The next step that we did we did a cost benefit analysis with our CFO and with Luna, and we did due diligence. With our RMO, we would've done our GDPR stuff and our risk assessment. The part of the lending process that was extremely important to us was the end to end journey for our members. We wanted it to be easy, and we wanted it to be professional and look sleek for our members.

The next stage then was initiation. Once we had chosen to go with Luna, we had certain requirements, and that we went through. We did this while we were during a global pandemic, so initially, Luna, Brian and Fergal were to come down on site, but they couldn't. We did it all remotely with them.

We started from, what does a member do when they come in? What's required? What does it look like? The odds looked on the side of the loan officers and myself. What do we have to do? What do we require? We mapped the customer journey, we identified the key objectives that the member would want, but also what we would need.

We identified pain points and current blockages. What were pain points for our members and for ourselves? For ourselves, by not having an online platform, members would send in inquiries via our website. A pain point where there was, they couldn't send us in all the information, they couldn't upload the documents.

We had to call them. Not being able to get them when we called them. Them having to call us back and we might miss them. Some of the big pain points for us, we couldn't get the member from when they went onto our website to apply or to inquire about a loan to go through the full process there and then.

It seemed to be. It could've been a couple of days before we were able to get back to them. Then, by the time we did, maybe they had come into one of the offices, or what we've seen, they might have gone to a competitor or might've been able to go online and get it straight away. That was one of the big pain points for ourselves.

Another pain point was, and Fergal and Brian worked through it with us was, we had an awful lot of trackers then, where we would track the journey that the member had to come with us.

When they first initiate, they contact via online, or via phone, or email, to when we were able to contact them, to be able to put the application up, to get all the documentation in securely with the members.

We looked at the potential opportunities then with Luna. Thus, there were other opportunities that we could've got as a result of Luna. We could see, with Luna, at an early stage, where our member was in the journey of the online loan application was extremely important for us.

Not only did we see what came in from Luna as a full application, but also, we got to see others that didn't come through as a full application and where they got stuck on us, which was very important. We didn't want to lose anybody as a result.

We did money workshops to show what it would look like at the very end. Fergal and Brian worked with me every week in relation to what we would like to see and what our vision was at the end of this.

Our next stage then was the planning. As a result of the initiation and doing all the workshops, we would've uploaded a lot of documents in relation to what we look for, our application forms, our trackers, and what our journey for our members would look like.

A very important report that came out of it was our Digital Assessment Report and our Return on Investment, which were two very important documents because the Digital Assessment Report brought true what we looked like at the moment before we brought in an online solution and what potentially, it could look like if we brought it in.

It showed all our pain points and how we could alleviate the pain points. It showed us the personas of what our members would look like and what they would require, also, from our loan officers, the credit committee, the board, what they would need out of a digital process, out of a digital online loan application.

With those, it was very important for us, because we were able to implement them then. They also showed us other things that we should be looking at as a result of doing this digital assessment, so it became a very important document for us. The return on investment then showed us, as a result of bringing in Luna over the three years, what were we going to achieve as a result of this?

It showed us what we were going to achieve in relation to the costs we put in, the time we were going to save as a result of having an online, straightforward solution for us, how our turnaround times were going to decrease as a result of this.

How members were going to get a decision quicker and better from us, and how our member customer satisfaction was going to be an awful lot better than what it was.

Then, the draft implementation plan. There was an implementation plan of exactly how it was going to look from the day we decided that we were going to introduce Luna right to the end of when it was going to be implemented. Again, that was very hands on from both Brian and Fergal, and myself.

We met every week, and we went through exactly the stages that we had to do, how we were going to put it in, and especially to the planning and even to the execution part of it, how was it going to look before we sent it out to our members? I'll go on to the next stage then, which was our execution.

We did a proof of concept. We asked all our family, friends, director of staff in the test environment to put up applications, come back with feedback as to how they found the journey, what they looked at. We were able to then, at that stage, send that feedback to Brian and Fergal of maybe little tweaks that made it easier for ourselves and our potential members on the platform.

We were able to do a lot of testing to better refine the customer experience. Little things like putting up a box to prompt a member to click a box, make sure it was more visible for our members. What was extremely important, we got the feedback back from our members, staff, colleagues, and directors.

When I fed that back to Luna, to Fergal, and Brian, they completely took it on board and were able to implement the changes for us. It looked like exactly what we wanted from the start of our initiation stage with Luna to just before going live.

It was exactly what we needed, and it looked like the journey one member would have if they were face to face with a loan officer, which was extremely important. We didn't want to be faceless. We didn't want it to not look like Carlow Credit Union. It had to look like us, and it had to look like they were talking to one of us via a computer screen.

We went live then with this, and what's extremely important is we've had weekly governance sessions with Luna, where we've had tweaks along the way of certain things that have come up that we didn't guess there in the proof of concept at the time.

Again, it's weekly sessions with them, and it's worked out very well because the loan officers also got to meet Brian and Fergal, who were doing the work on Luna and were able to tweak it slightly to make it more customer friendly or member friendly for our members. Again, the return on investment, it wasn't just doing it at the start and forgetting about it.

Fergal has been in contact every single month about repeating the return on investment in three months after the rollout, seeing how it has worked after three months, making sure that we are getting what we had initially started to do at the start. Obviously, for the first three months, there were a few tweaks, and we didn't market it straight away.

We had a soft launch on it, so the first three months might be exactly what the next three months are going to be when we have a harder marketing plan in place. The return on investment, they don't forget about it. It's there, again, for us to do to make sure we're getting exactly what we needed to get out of Luna, which is very important.

I suppose the main thing, what we achieved over the three months since we've launched Luna, six percent increase in new borrowers applied online via Luna for lending. Those loans were anything from 20,000 up to 110,000 that applied, got approved, and issued via Luna. Over 30 percent of loans issued in quarter one were sourced via Luna Connect.

30 percent of our loans in the last three months were solely from Luna Connect. Again, just want to reiterate, we did a soft launch at the start for marketing in relation to the Luna Connect. People didn't know we weren't promoting it to our members, but they saw it online and were well able to go in and get it.

Our online loans increased the average loan value by 5.25 percent overall in our loan book, which is very important that our average loan is increasing as a result of this. We saw that applicants were starting to become more professional who had no previous borrowings with Carlow Credit Union.

They were double income with no mortgages, which is very important that we saw that professionals that had never borrowed from us before and weren't members, were able to look around at lending, saw Carlow Credit Union, and were able to apply for a loan and become a member at the same time, which is very important.

The feedback from them was phenomenal because they couldn't believe that they could do that with a credit union, which was great. That was without us marketing very heavily either. The quality of integration of data resulted in increased service level agreements, so what came in, we were able to underwrite a loan without having to speak to the member.

The information, again, like what I said, was very important. We wanted it to look like exactly what a member would do when they came into Carlow Credit Union. The information that is up on the Luna form is exactly what we would ask. The documentation they would've had to upload is exactly what we would look for.

After a notification came in, the loan officer was able to download it and was able to underwrite it from start to finish and be able to issue approval without having to forward the member because the quality of the data that came in via Luna was extremely strong. The other good thing that we have found with Luna as well is the MI in the reporting.

Luna have every month, we can download the exact details of what happened in the month, of the applications that came in, of the ones that were approved, declined, were canceled, the ones that were in progress.

It gave us clear MI that I was able to report to the credit committee, the CEO, and to the boards on exactly, "This is what Luna is doing for us. This is the MI and the output of what we're getting from Luna." Again, what I can't reiterate is the service level agreement for our members. How quick we were able to turn around a loan because of the data that we had there, which was very important.

The next thing there is the roadmap, then the end to end remote journey, including digital marketing, digital identity, and digital signatures. This is our next process that we're going down. We're doing a lot of work with Fergal and ourselves in relation to marketing it. Looking at how we can market it going forward.

Looking at the KYC part for members to be able to upload their ID documentation for AML, and looking at digital signatures without them having to come in or draw it out with ourselves, that we can remotely sign everything, so they don't have to come in to us.

Integration with our banking platform increases the levels of automation. What we want, even though 30 percent of our members came through Luna in the first quarter, we'd like that to increase without them having to come in. That's what the digital marketing is going to help us with that.

Like that, Luna Connect is aligned to our digital strategy, so it is one of our core strategies of our marketing plan and of our strategic plan is to use Luna in relation to getting applications in. That's everything that was said.

The conclusion, the timing. With the global pandemic, people having to cocoon, lockdown was perfect timing. A lot of members didn't want to come in. I'm sure a lot of credit unions, we didn't want them to come in during the pandemic. I had started the process with Luna at the start, but we had to escalate it.

Luna could work with me in relation to me wanting to get it to go live during the pandemic, so we had another option for our members, which we were able to do. The exposure, we were able to acquire new eclectic members. Again, we were able to acquire professional members, acquire members that were looking for a larger [inaudible 19:00] .

As you can see that our average loan went up to 5.25 percent in that quarter. Risk management, assisting with diversifying the loan book. We were able to diversify the loan book by having the larger borrowers coming in with us, having borrowers that never borrowed with us before and also, brought up our member base as well.

The most important thing, it aligned with our strategy. The past strategic plan from the last number of years, what we had to get a [inaudible 19:29] digitalization online onboarding membership. We needed online loans. It was part of our digitalization strategy and our objectives for many years.

As we went through the tender process for the three providers, Luna, the one that best fit with ourselves, they were able to align us with exactly what we wanted, and more importantly, exactly what our members wanted from any of the market research we did in relation to our [inaudible 19:52] and our current members.

The figures speak for themselves in the first quarter that we have done and have fitted in very well with Carlow Credit Union. That's it.

Luna Connect

Fergal: Thank you, Siobhan. Brian, do you want to take it over from here

Brian D'Arcy: Yeah. Thanks very much, Siobhan. That was great. What I'm going to do next is bring you through the tech piece of it and what the tech that we put in place to support Siobhan and Carlow Credit Union as part of this digital transformation journey.

The first piece that I'm showing here is the borrower portal. This is where your member or your non member can go to complete their loan application online. One of the key things in the process was what we put in was automatic common bond validation.

Here is the first step in the process where the borrower can enter their address or area code, and then we automatically validate in real time if they're part of the common bond or not. If they are, then they can proceed with their application. If not, we stop it there and don't let them proceed any further.

This is very important when pursuing an online strategy because once you open up and put your application process online, it's open to the world, and there's potential there could be a lot of noise. Just by putting in this check upfront, you're reducing the noise, and you're stopping your lending team from getting overwhelmed with applications that aren't going to go anywhere.

Once the common bond is validated, then we're able to let the applicant proceed. From there, the first thing we do is we set up a secure password protected account. This means that the borrower can return to their application at any stage.

If they have to go away and maybe get some documents they need to upload later, or if they need to complete a later stage, their data is secure. That's fully GDPR compliant. Once the borrower has that setup, then they're able to start filling out their loan application. Here, we guide them through the different steps in the process.

Also, if they are a new member, then we also include that new member application as part of the process. We're not breaking it up into separate journeys. We're bringing them through that full end to end in one simple process. Again, this is very important.

Siobhan said this already, but what we've seen, if you look at alternatives in the markets of all the other digital alternatives that people can go to get their money, they're not forced into these multiple fragmented journeys where they're forced to do different things. It's all in one end to end process.

That was a key part of the process, just to make sure that you don't end up with these high abandonment rates where people drop off halfway through. Once the loan application is completed, and you've gathered all the information, a personalized task list is generated. This task list is based on the credit union's products and credit policy.

These are configured in Luna Connect, and then this task list is generated and asks the borrower to complete the task that they need to finish this loan application. For example, if it's a new member, we're going to ask them to do the digital onboarding. If it's one of those, might be uploading their PPS, proof of PPSN documents, uploading bank statements, things like that.

This whole checklist at the end is personalized to how they've answered the questions and what products they've selected. As well as that, Luna Connect monitors this task list, so it's not just sitting there. We're monitoring it. If we notice that there's tasks that haven't been completed, we send notifications to the borrower.

We'll automatically do the follow ups in the background so that your lending team isn't constantly ringing people and contacting people trying to get them to send in the documents that they need. This reduces the amount of time that the lending teams spend following up and checking with people all the time.

We'll automatically send emails, but then also automatically validate the documents when they upload something that is a valid document, and it is what it's meant to be. The next thing we're looking at here is, what do those tasks look like?

The first one here is the ability to upload their documents. This can be done from any device. If it's completed on a mobile phone, the borrower can use their camera to take a picture. If they're on their laptop, they can upload directly. Like I said, we validate the documents as they're being uploaded.

For new members, they complete their digital onboarding. This can all be done within the same journey again, so we're not sending them off somewhere else to do digital onboarding or KYC. It's all embedded in the process. They never leave Luna Connect to complete that step.

For things like bank statements, again, we give them the option where they can upload a document, but then also, having an integration with open banking so they can connect directly to their account, and we can pull in that data automatically.

Once that borrower journey has been completed, so they've completed a loan application online, they've completed all their tasks in the tasks list, Luna Connect has validated that, "Right, this all looks good," now, we're switching over to the Luna Connect Lender Console. This is the view that your lending team will get at the platform once a loan is submitted.

The task board here will show each loan application, what stage in the process it's at. Here, you can manage that loan application pipeline through your own process from something that's new is a loan application that's in progress.

We've found that it's very important not just to show the loans that have been completed but also showing as soon as someone starts the loan application, we're recording it, and you can see how far they're progressed in that and where they are in the process.

The task complete is when everything is ready to go, and this is ready for your team to pick up, and then you can bring it through your process room. In progress, approved, declined, or canceled. Each one of these boxes here is a loan application.

When you click on one of these, you drill down into the dashboard, and you can see all the details of that loan application. Everything from all the information that the borrower has put in is part of filling out the loan application form, all the documents that have been upload, any bank accounts that have been connected.

As well as that, we'll run our algorithms and our AI models in the background to analyze the data and display visualizations to help you make those decisions and analyze the data quicker than you do when you're reviewing everything manually. Then we're switching here now more to the MI or the management dashboard's component of it.

This is a very important component of the back end for these management dashboards or providers. Here, the management team can monitor the performance of the lending business in real time.

You can see how loans are trending month over month, what products are performing well, what your turnaround times are like, are loans going to the members versus non members, there's how many top up loans there are. All this in a single dashboard that's updated in real time as we're processing the data.

As well as that, you can view your online and your marketing data alongside it, and then you can also bring in any external data sources that you need to include in your reporting and any other visualizations that you want to perform. That's it, a walkthrough of the tech that underpins everything that Siobhan has been talking about.

Thanks very much for your attention as we went through that. Mr. Fergal outlined, if anyone would like to learn more about what we've done, we're quite happy to go into more detail on that.

Q&A

Fergal: Thanks, Brian. Looking at the Q&A window, there's lots of questions coming in. I'll select a few with the time we have left. Everybody should see that Q&A if you want to submit a question. I'll pick a few out of here. This is probably for you, Siobhan. What percentages of the applications process through Luna were approved?

Siobhan: In over three months, we have 73 percent of them have approved of what came in. I would expect that to increase over time because I think at the start maybe people were just putting it in without giving it the additional documentation because they weren't sure about it. We were quite happy with our 73 percent over the quarter.

Fergal: This one, Brian, is probably for you. It's on common bond verification. Does it allow for work addresses in the event they're living outside of common bond?

Brian: Yeah. You might've seen on the screen that there was the option where you can say, "Do you work, live, or study in the common bond?" Yeah, the address validation that we have in there can take either home addresses or business addresses. It'll work with either.

Fergal: Very good. A few questions on integration with the banking systems. Brian's probably going to outline integration. Maybe talk a little bit about integration. I'll just take all the questions as one.

Brian: The whole platform from Luna Connect, so everything that we walked through there, it's a very open platform. Everything that we showed, there's an API behind it. What that means is if there's an API there, it makes it very, very easy to get data in and out of Luna Connect.

Any integration with Luna Connect to our API platform can be done with just a couple of API calls. For any downstream provider who needs to pull in data out from Luna Connect, it's very, very straightforward. It's not a lot of work to do.

Fergal: Thanks, Brian. Another question here on credit checks, are credit checks done on CCR?

Siobhan: They're done on the banking model, that's through Luna, so on whatever banking model you're using.

Brian: Right now, with Siobhan, the CCR checks are still done the same way they always were. One thing that we have on our roadmap, which again, if anyone wants to talk to us, we're more than happy to go down the details of, is to see how we can bring more automation stuff back in process? In part, that would be done via automatic CCR checkers as part of that.

Fergal: They're coming flying in. [laughs] Just one here. Probably, I can answer this one. Give you a break, Brian, too. Is there a feature to record loan leads that don't come in as an online application?

Yes, we're building out into Luna Connect working with a credit union on that. That's where they're getting lots of leads, getting their website inquiries through all their channels, whether that's email, or LinkedIn, or Facebook, whatever and record them. Then, look at them and bring them into Luna against the member database that we load up into Luna, and then look at the conversion rates.

A very good question on that, because that's a very hot topic, you're promoting online lending, so what is the conversion rate of people inquiring about actually making a loan application? Yes, that feature will be available soon. Going to try and choose some more questions.

A question here to you, Siobhan. What were your challenges on deploying the application to the lending team? It's a new application that's deployed to the team. Obviously, it's change management and governance to take care of.

Siobhan: What we got [inaudible 32:32] ourselves was there wasn't much pushback on it. They were delighted because our process before that with website inquiries and that was a longer and tedious process to try and get conversions on, where the conversion on Luna is much easier. The documents were there straight ahead of them every time they went in.

Again, adding tweaks that we needed to get done, which [inaudible 32:52] were done, and the lending team are very happy with this. We see thus, as a result, the members are happy as well, so there was no issue at all on that side.

Brian: To add something there as well, something that we learned on the Luna Connect side as part of that process, we initially had put a lot of focus on the user experience of the borrower, whether that was a member or a non member coming along, and what that user journey would look like. I suppose we focused on that and tried to understand that.

Then, as we started working with Siobhan and her team, we understood that the user experience on the back end was just as important, if not more important. Remember that your lending team is going to be in the console application every day, so if they don't have a good user experience as well, it's not going to make their jobs easier.

They're going to get annoyed with. They're going to get frustrated. That's something that we learned through the process. As Siobhan said, there was lots of feedback, and we were tweaking and making changes to the user experience as we've gone along.

That, again, that's something that we've put a big focus on is making sure that your lending team has a good app that helps them do their job, that's not annoying them or making their lives harder.

Fergal: Thanks, Brian. Siobhan, another question here on artificial intelligence. Can you talk a little bit about artificial intelligence, machine learning? How do you apply it? I have seen something on your website on this.

Brian: I can save that one as well. Artificial intelligence, machine learning, it's something that you'll hear a lot about people throw out there as a buzzword. I suppose with Luna Connect, it's something that we've built into the product from the start.

What that means is we use it in a few different ways. One thing we do is automatic validation of documents. That's something that's really, really time consuming today. With Luna Connect, what you do is when you upload a document, we have our bots running in the background that are checking that document, seeing, is it a real document?

One thing Siobhan said to us when we initially went live was, "See the picture of every coffee table in Carlow, because people are just taking pictures of anything." What we do with Luna Connect is we validate those documents. We say, "Upload proper PPSN." We scan it. We look at it. We check, it has a PPSN, it's in the right format, and then we approve the document.

There's a lot of artificial intelligence in the background that's learning what documents look like and how they're processed. Another component that we have in there is around decision support. It's not, "Computer says yes," or, "Computer says no."

What we can do is we can take your existing loan book and your existing loan applications, we try and up our model using that data, and then as new loan applications come in, you can use the model to have product protection against that.

What that does is a few things. It can be used as another data point that you use to make a decision, but as well as that, it helps you prioritize your workload. If you've got a lot of loans coming in, you can see that straight away, this one is a good match with the type of loans that we like to do, or we've done in the past. Then, you can prioritize that and get people to work on it.

There's real applications of artificial intelligence and AI working in the background. To be honest, people won't notice, but it's done a lot of the work and makes life easier for the lending team.

Fergal: Thanks, Brian. Plenty of questions coming through. Conscious of time, we did say 40 minutes, so I'll take one or two more. This is probably for you, Siobhan. Can you talk a bit about marketing, your marketing efforts to date? What works, doesn't work, what you intend to do.

Siobhan: At the time, we started off very softly on us. We did a video that we were able to put out across all our platforms, social media platforms, and our website, and everything. We've done enough, a lot of in house promotion. Any promotion that we're doing [inaudible 37:10] the option for a Luna Connect to others.

We're very fortunate that we have acquired large billboards in our Carlow area that we could put a full billboard on our outdoors of Luna Connect on the online option. We also, across our local media, then radio and "The Nationalist," or our local paper, we advertised a little. It's worked out very well for us.

I think we're getting to a stage where for a lot of members, our first protocol is to go to Luna Connect. I know somebody asked a question there in relation to leads and thus, what's very important with Luna Connect is, when you come into the model, you have your applications that actually went to full application upload and our documents and everything.

A great tool to it is, the people that started the journey, that might've only gone to page one or two, we can see where they went to. It's lead generations for you, then, to be able to forward the member to see, why did they stop? Did they need any help? Our conversion rate for them is quite high as well, at 80 percent of getting them over to full applications.

That's one part that we didn't know at the time when we were going with Luna that was going to be as strong, and it's one of our strongest tools now with this online application.

Fergal: Thanks, Siobhan. Conscious now, it's 40 minutes, so can I take questions in the Q&A window? We will answer everything on email.

Transcription by CastingWords