Recent Posts

Automating Digital Lending with Robotic Process Automation (RPA)

Mar 3, 2021 1:18:02 PM / by Brian D'Arcy posted in webinar, rpa

Season's Greetings from the team at Luna Connect

Dec 23, 2020 12:52:26 PM / by Brian D'Arcy

Helping SME's access finance quicker with automated loan-origination processes

Nov 23, 2020 11:18:00 PM / by Brian D'Arcy posted in SME Lending, Asset Finance, webinar

Learn how SME Finance and Leasing Solutions are transforming lending

Access our On-Demand Webinar and learn how SME Finance and Leasing Solutions DAC are transforming lending for SME's, including a very insightful Q&A with Declan, Darren and Brian covering customer service, digital transformation, Covid-19 and Open Banking.

- Declan Roche SME Finance & Leasing

- Darren Greenyer Anchor Computer Systems

- Brian D'Arcy Luna Connect

Learn about

- Growing a diversified loan book online

- Delivering high levels of customer service through digital channels

- Transforming operations with real-time reporting and analytics

- Reducing costs with automation and end-to-end integration

Simpler, Quicker, More Efficient

Oct 26, 2020 11:18:00 PM / by Brian D'Arcy posted in Credit Union, webinar

Learn how Carlow Credit Union are transforming lending

Access our On-Demand Webinar recording and listen to Siobhan Gray, Head of Lending, on how Carlow Credit Union are transforming through digital lending.

Learn about:

- Increasing lending to Members and Non-Members

- Building a Member and Non-Member experience through Digital Lending

- Transformation in Lending and Underwriting Management

- Emerging digital trends in loan (lending) origination

- Seamless Identify (Know Your Customer) Management

Practical Guide to Open Banking and PSD2 Part III

Jun 20, 2020 8:05:40 PM / by Brian D'Arcy posted in Luna Connect, AI, Digital Lending, open banking, psd2

When talking to customers about Open Banking the two questions we get asked most frequently are 1) can I see it in action (does it really exist) 2) do I need to be a registered AISP. I'll be going through both of these in this post. If you haven't already read the other two posts in this series check them out here Practical Guide to Open Banking and PSD2 Part I: Lending, and here Practical Guide to Open Banking and PSD2 Part II: Are you ready?

Customer Case Study: SME Finance and Leasing

Jun 12, 2020 3:47:07 PM / by Brian D'Arcy posted in Luna Connect, Digital Lending, SME Lending, Asset Finance, customers

Helping small businesses access finance quicker with automated loan-origination processes

Small businesses rely on finance options to purchase and upgrade the assets that are essential to their growth. Traditionally, applying for finance was a time-consuming and frustrating process for the customer, requiring extensive paperwork and a lengthy wait for a decision.

Luna Connect is revolutionising the loan-origination process, utilising automation technology to help traditional lenders compete online and to help small business owners access finance quickly and effectively.

Recently, we worked with Irish company SME Finance & Leasing to increase their market share by providing a convenient and easy-to-use online solution for their borrowers.

Practical Guide to Open Banking and PSD2 Part II: Are you ready?

May 23, 2020 3:05:20 PM / by Brian D'Arcy posted in Luna Connect, AI, Digital Lending, SME Lending, open banking, psd2

In this post I'll outline how to plan your Open Banking project, and ask is Open Banking ready, is your business ready, and most importantly are your customers ready. If you haven't read Part I of this series you can read it here Practical Guide to Open Banking and PSD2 Part I: Lending.

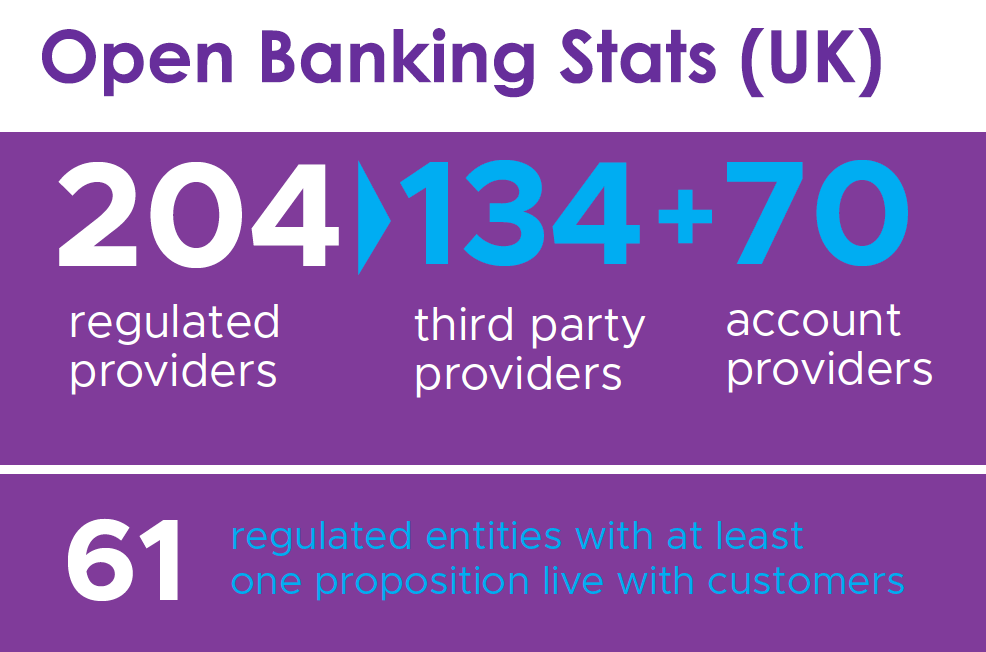

The OBIE in the UK publishes a monthly report on the Open Banking ecosystem, regulated entities and providers. This is a great source of information on adoption, and the Open Banking February Highlights provides stats on the number of successful API calls having risen from 280.5 million to 321.3 million (December 2019 to January 2020).

Practical Guide to Open Banking and PSD2 Part I: Lending

May 16, 2020 3:28:59 PM / by Brian D'Arcy posted in Luna Connect, Digital Lending, SME Lending, open banking, psd2

In this post, and the next 2 blog posts, I'll cover how Open Banking and PSD2 can be used practically, today. Lending is changing from face to face and phone interactions to self-service online digital experiences, and this is being accelerated globally to protect staff and customers from the spread of COVID-19 (Coronavirus). Data and APIs are the key ingredients in driving down costs and risk, increasing automation, and delighting borrowers with amazing customer experiences.

Automating Small Business Lending with AI

Nov 1, 2019 8:36:00 PM / by Brian D'Arcy posted in Luna Connect, AI, Digital Lending, SME Lending, fintech

Artificial Intelligence is transforming the way we bank. Fintech companies and start-ups are causing a revolution within the lending world, and as the ever-growing importance of data analysis for making informed business decisions increases, so does the demand for artificial intelligence and automation in modern business.

Luna Connect is Silicon Republics Start-up of the Week

Aug 23, 2019 9:11:00 PM / by Brian D'Arcy posted in Luna Connect, AI, Digital Lending, SME Lending

Silicon Republic: Our Start-up of the Week is Luna Connect, a digital platform for lenders that makes it easier to provide loans online